What is SET?

Secure Electronic Transaction (SET) is a suit of protocol that has been

developed and promoted by a consortium of Visa and MasterCard to ensure

security of online financial transactions.

The idea with SET is that a combination of digital certificates is used

to ensure the security requirements of transactions between the consumer,

merchant, financial institutions, and the payment gateways.

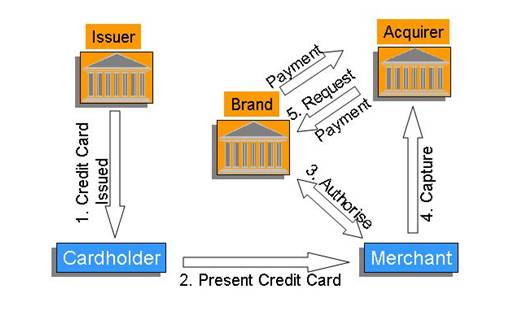

In absence of SET credit card transactions between the consumer,

merchant, and financial institutions take place as indicated in the diagram:

- Issuer

(could be consumer's High street bank) issues consumer with the credit

card

- Cardholder

(consumer) presents the merchant with his credit card for payment along

with the order

- Merchant

requests and receives authorisation of payment from the credit card brand

(could be Visa, MasterCard, American Express, etc) before processing the

order

- Having

received authorisation from the brand, merchant initiates the process of

capture of monitory funds through the acquirer (could be Merchant's High

street bank)

- Acquirer

forwards authorisation details to the brand and requests settlement from

the brand

- Having

received payment from the brand, acquirer credits Merchant's account with

the funds

- Brand

bills the consumer for the funds

The process described above is followed whether or not transaction is

online. One major problem with this

process is that consumer's sensitive information (credit card information) is

divulged to the merchant with potential privacy implications for the consumer. There is also the issue of authentication of

both the consumer (is the consumer the true cardholder) and the merchant (is

the merchant who the consumer believes to be or is the Web front merely a front

to the adversary's website). SET is designed

to overcome these issues through authentication of all bodies with the use of

digital certificates.

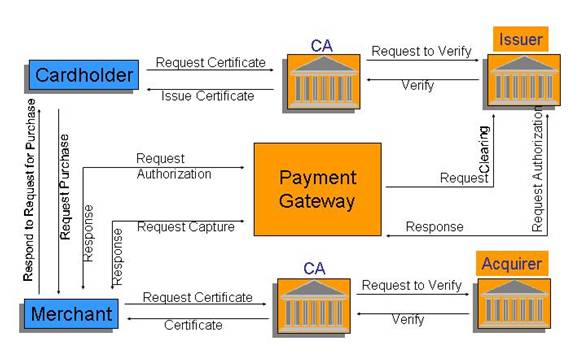

SET works

as shown in the diagram above:

- Consumer (cardholder) obtains

digital certificate from the

issuer. Note that the issuer (for

example Visa) can act as a certificate authority or an

approved certificate authority is used for the process in which case verification

of the issuer is obtained by the CA before certification of the consumer.

The consumer's digital certificate contains among other things, consumer's

public key, issuer's public key and credit details and it essentially amounts

to consumer's credit card that can be used for online payments. A software application called the digital wallet

is installed on the client. Digital

wallet stores consumer's digital certificates in encrypted form. These certificates would in turn be used

for online credit card payments. This

means that credit card information does not need to be inputted every time

consumer needs to make a purchase.

- Merchant obtains a digital

certificate from his bank (acquirer) that acts as CA or another CA that is

approved by the acquirer. There is

also another entity called the payment gateway that is set up by the

financial institutions to process online payment transactions. Payment gateways are certified by a CA

that is approved by the acquirer. Merchant's

certificate includes merchant's public key and payment gateway's public

key

- Consumer places his order to

the merchant online and consumer's browser ensures the authenticity of the

merchant through merchant's certificate that arrives at the client.

- Client's digital wallet sends

the order to the merchant. Transfer

of consumer certificate to the merchant, ensures the merchant that the

account number is valid and approved by the issuer. This so called order is in two parts:

- One part is the information

about the order (the products, services, delivery address, etc). This information is encrypted using

merchant's public key.

- The other part is the payment

information that is encrypted using payment gateway's public key.

With this strategy merchant can only access the order

information and the financial institutions can only access the payment

details. Note that SET protocol uses SSL

for the secure communication. Integrity

and non-repudiation is ensured through creation of two digital signatures, one

for the merchant (by encrypting the message digest of order information) and

the other for the issuer (by encrypting the message digest of payment

information). This concept is called the

dual

signature.

- Merchant forward the order to

the payment gateway in order to get authorisation for the payment. Authorisation is obtained from the

issuer and forwarded to the merchant.

- Merchant processes the order

and requests capture through the payment gateway

For more,

see:

http://www.tcm.hut.fi/Opinnot/Tik-110.501/1996/seminars/works/set/SET.html

http://www.setco.org/faq_usr.html

|

What's

the difference between SET and SSL? |

|

|

|

What

is SETco? |

|

|

|

What

is the improvement in protection with SET? |

|

|

|

What

are the key benefits of SET for merchants? |

|

|

|

What

is SET mark? |

|

|

|

How

can you tell if a website has SET technology? |

|

|