What is online payment processing?

This document discusses the following topics

l

Online Payment Processing Basics

–

The Payment Processing Network

–

How Payment Processing Works

l

What You Should Know About Fraud

l

What to Look for in a Payment Processing Solution

Basics – Payment Processing

l

For payment processing to work correctly

–

merchants must connect to

a network of banks (both acquiring and issuing banks), processors, and other

financial institutions so that payment information provided by the customer

can be routed securely and reliably.

–

The solution is a payment gateway that connects your

online store to these institutions and processors. Because payment information

is highly sensitive, trust and confidence are essential elements of any payment

transaction.

–

This means the gateway should be provided by a company

with in depth experience in payment processing and security.

Payment Processing Network

l

Acquiring Bank

–

In the online payment processing

world, an Acquiring Bank provides Internet Merchant Accounts.

–

A merchant must open an Internet

Merchant Account with an Acquiring Bank to enable online credit card authorization

and payment processing. Examples of Acquiring Banks include

–

Merchant eSolutions and most

major banks.

l

Internet Merchant Account

–

A special account with an

Acquiring Bank that allows the merchant to accept credit cards over the Internet.

–

The merchant typically pays

a processing fee for each transaction processed, also known as the discount

rate.

–

A merchant applies for an

Internet Merchant Account in a process similar to applying for a commercial

loan.

l

Authorization

–

The process by which a customer's

credit card is verified as active and that they have the credit available

to make a transaction.

–

In the online payment processing

world, an authorization also verifies that the billing information the customer

has provided matches up with the information on record with their credit card

company.

l

Merchant

–

Someone who owns a company

that sells products or services.

l

Payment Gateway

–

A service that provides connectivity

among merchants, customers, and financial networks to process authorizations

and payments

–

The service is usually operated

by a third-party provider

l

Credit Card Association

–

A financial institution that

provides credit card services that are branded and distributed by Customer

Issuing Banks. Examples include Visa® and MasterCard ®

l

Customer

–

The holder of the payment

instrument such as credit card, debit card, or electronic check.

l

Processor

–

A large data center that processes

credit card transactions and settles funds to merchants.

–

The processor is connected

to a merchant's site on behalf of an Acquiring Bank via a Payment Gateway.

l

Settlement

–

The process by which transactions

with authorization codes are sent to the processor for payment to the merchant.

Settlement is a sort of electronic bookkeeping procedure that causes all funds

from captured transactions to be routed to the merchant's acquiring bank for

deposit.

l

Customer Issuing Bank

–

A financial institution that

provides a customer with a credit card or other payment instrument.

–

Examples include Citibank,

Suntrust, etc.

–

During a purchase, the Customer

Issuing Bank verifies that the payment information submitted to the merchant

is valid and that the customer has the funds or credit limit to make the proposed

purchase.

How Payment Processing Work?

Payment processing in the online world is similar to payment processing

in the offline or “Brick and Mortar” world, with one significant exception.

In the online world, the card is “not present” at the transaction. This means

that the merchant must take additional steps to verify that the card information

is being submitted by the actual owner of the card. Payment processing can

be divided into two major phases or steps: authorization and settlement.

Authorization verifies that the card is active and that the customer has

sufficient credit available to make the transaction.

Settlement involves transferring money from the customer’s account to the

merchant’s account.

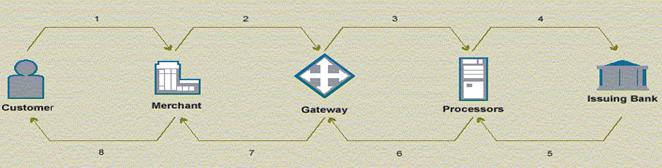

Payment Processing – Authorization (Online)

l

Customer decides to make a purchase on Merchant’s Web

site, proceeds to check-out and inputs credit card information.

l

The Merchant’s Web site receives customer information

and sends transaction information to Payment Gateway.

l

Payment Gateway routes information to the Processor.

l

Processor sends information to the Issuing Bank of the

Customer’s credit card.

l

Issuing Bank sends transaction result (authorization

or decline) to the Processor.

l

Processor routes transaction result to the Payment Gateway.

l

Payment Gateway passes result information to Merchant.

l

Merchant accepts or rejects transaction and ships goods

if necessary. Because this is a “Card Not Present” transaction, the Merchant

should take additional precautions to ensure that the card has not been stolen

and that the customer is the actual owner of the card. See the “What You Should

Know About Fraud” section for more information on

preventing fraudulent transactions.

Payment Processing – Authorization (Brick and Mortar)

l

Customer selects item(s) to purchase, brings them to

cashier, and hands credit card to Merchant.

l

Merchant swipes card and transfers transaction information

to a point of sale terminal.

l

Point of sale terminal routes information to the Processor

via dial-up connection (for the purposes of the graphic above, the point of

sale terminal takes the place of the Payment Gateway in the offline world).

l

Processor sends information to the Issuing Bank of the

Customer's credit card.

l

Issuing Bank sends transaction result (authorization

or decline) to the Processor.

l

Processor routes transaction result to the point of sale

terminal.

l

Point of sale terminal shows Merchant whether the transaction

was approved or declined.

l

Merchant tells the Customer the outcome of the transaction.

If approved, Merchant has the Customer sign the credit card receipt and gives

the item(s) to the Customer.

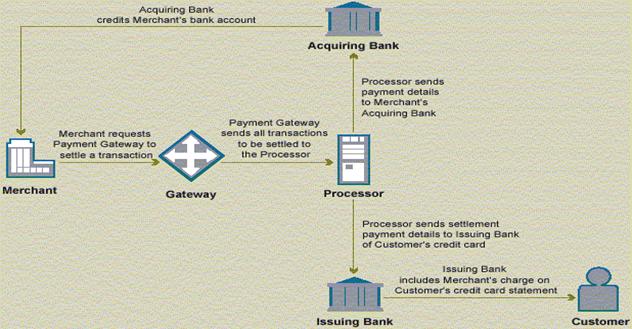

Payment Processing —Settlement

The settlement process transfers authorized funds for a transaction from

the customer’s bank account to the merchant’s bank account. The process is

basically the same whether the transaction is conducted online or offline.

What You Should Know About Fraud

l

Credit card fraud can be a significant problem for

–

customers,

–

merchants, and

–

credit card issuers.

l

Liability for fraudulent transactions belongs to the

credit card issuer for a card-present, in-store transaction, but shifts to

the merchant for “card not present” transactions, including transactions conducted

online. This means that the merchant does not receive payment for a fraudulent

online transaction.

l

Fortunately, there are steps you can take to significantly

limit your risk as an online merchant.

l

Choose a payment services provider that is well established

and credible. Your provider should also have in-depth experience in and a

strong track record for transaction security.

l

Make sure your payment gateway provider offers real-time

credit card authorization results. This will ensure that the credit card has

not been reported as lost or stolen and that it is a valid card number.

l

One of the simplest ways to reduce the risk of a fraudulent

transaction is to use Address Verification Service (

l

Use Card Security Codes (Cardholder Identification), known as CVV2 (Card verification Value) for Visa,

CVVC for MasterCard, and

–

For American Express, the code is a four digit number

that appears on the front of the card above the account number.

–

For Visa and MasterCard, the code is a three-digit number

that appears at the end of the account number on the back of the card.

–

The code is not printed on any receipts and provides

additional assurance that the actual card is in possession of the person submitting

the transaction.

–

As a merchant, you can ask for this code on your online

order form.

–

Even if you do not use this for processing, simply asking

for it acts as a strong deterrent against fraud.

l

Watch for multiple orders for easily resold items such

as electronic goods purchased on the same credit card.

l

Develop a negative card and shipping address list and

crosscheck transactions against it. Many perpetrators will go back to the

same merchant again and again to make fraudulent transactions.

What to Look for in a Payment Processing Solution

l

Finding a reliable, secure, and flexible payment processing

solution for your business is critical, so it’s important to take the time

to investigate and assess the options available to you. A payment processing

solution should:

–

Reliably and cost-effectively accept and process a variety

of payment types, including credit cards and electronic checks. Not only does

this reduce lost sales, but it also enhances the quality of your site by allowing

your customers the freedom and flexibility to pay you quickly and conveniently.

–

Provide real-time credit card authorization results allowing

you to accept or reject orders immediately and reduce the risk of fraudulent

transactions.

–

Easily track and manage payments from multiple payment

types or processors so you can spend more time on your business, not on managing

transactions.

–

Be able to act as a virtual terminal to allow for processing

offline transactions.This gives you the flexibility to process orders received

via telephone, fax, e-mail, or in person.

–

Provide and store transaction records letting you to

easily search for transactions and create transaction reports.

–

Scale rapidly and seamlessly to accommodate increased

transaction volumes so your systems grow as your business grows.

–

Provide flexible, easy integration with the Merchant's

Web site. The sooner you can start accepting payments, the sooner you start

generating revenue from your site.

–

Be able to work with all the leading Internet Merchant

Accounts, which allows you to switch your banking relationship and not have

to worry about installing new software or performing new integrations.

–

Be provided by a well-established and trustworthy company.

This ensures that your payment service provider will continue to provide reliable

payment services as well as new features.

|

Trust

Commerce, Merchant commerce,

and Authorize.net are three

comapnies that provide online payment soloutions. Look them up and make

notes about their services. |

|

|